14/05/2020

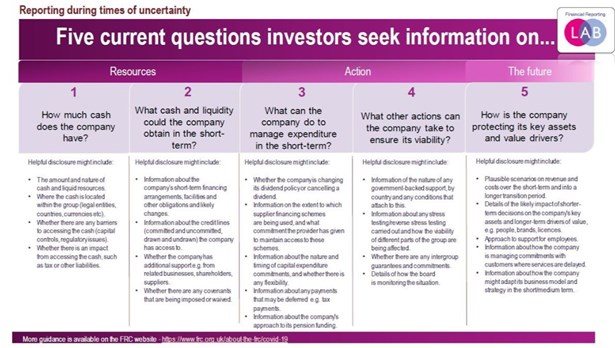

The FRC has published guidance on Corporate Reporting in the wake of the Coronavirus. It states: "Investors have highlighted that their key information needs relate to the liquidity, viability and solvency of companies. Boards cannot predict the extent and duration of the COVID-19 pandemic ... It is however reasonable for investors to expect companies to be able to articulate their expectations of the possible impacts on their specific business in different scenarios... Investors and other users of corporate reports want to understand a company’s resilience in the face of current uncertainty."

... and our suggestions as to how you can best articulate your answers ++

We're here to help you convey key information in the best, most precise and economical way as possible. You might wish to consider the following:

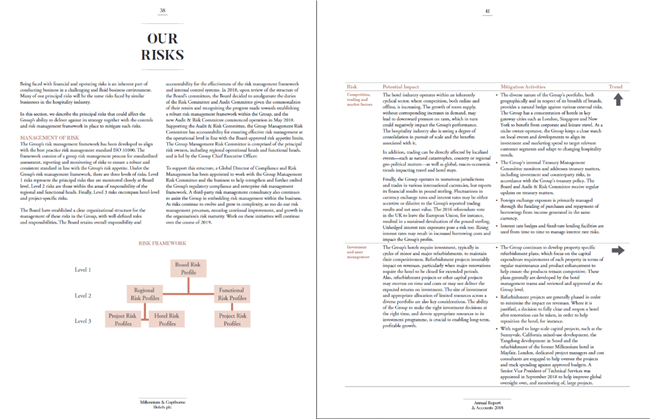

Straight text, two-column format

~~~~~~~~~~~~~~~~~~~~~~~~~~~

Articulating the potential impacts of Coronavirus in a pure text format shows a straightforward, practical approach. Two columns make it more interesting.

(Image taken from Millennium & Copthorne Hotels' Annual Report 2018)

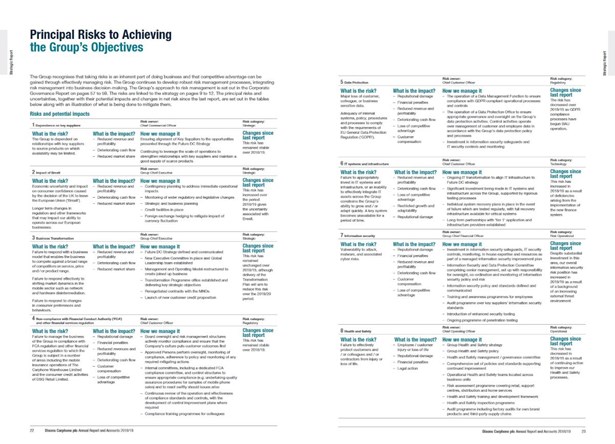

Risk table with columns

~~~~~~~~~~~~~~~~~~~

Using columns with appropriate headings provides an immediate and accessible format to separate liquidity, viability and solvency impacts.

(Image taken from Dixons Carphone's Annual Report 2019)

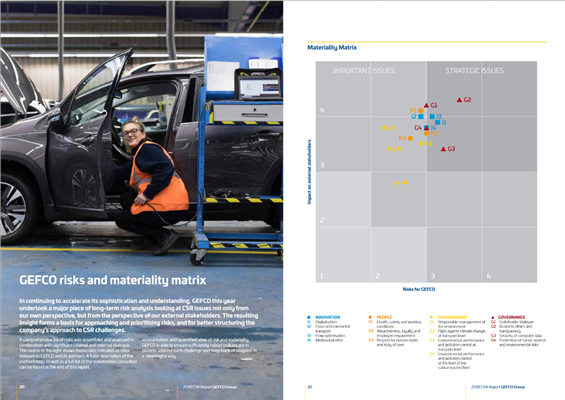

Using graphics

~~~~~~~~~~

Using graphics such as a Heat Map alongside text and tables can quickly aid understanding of the impact of the Coronavrus on key business areas.

(Image taken from GEFCO's Annual CSR Report 2018)