11/07/2023

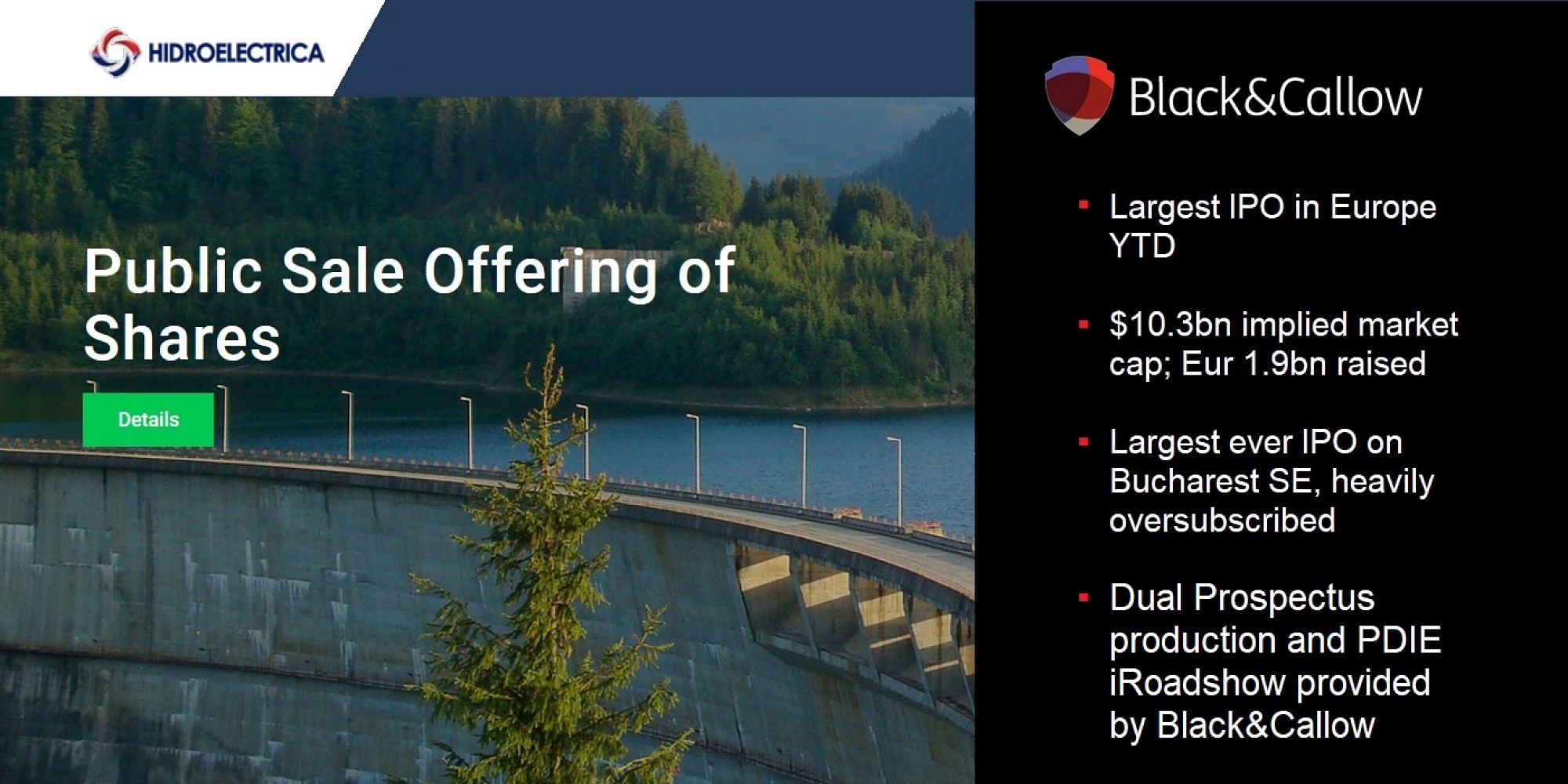

We couldn’t be more delighted than to have assisted with the largest European IPO this year and the largest ever IPO on the Bucharest Stock Exchange, for Romanian energy producer Hidroelectrica, in what a government minister described as a "historic success."

Black&Callow produced both the Romanian and English language versions of the 418-page Prospectus, assisting with typesetting, proofing, printing and distribution, as well as creation of the cover and digital downloads.

iRoadshow from Black&Callow was also utilised for the PDIE stages of the issue.

The heavily-oversubscribed IPO has been priced at 104 lei ($22.87) per share, implying a market capitalisation of $10.3bn. The pricing of the new issue was around the middle of an indicated price range of 94-112 lei.

"We are happy to see the strong investor interest which has driven a successful outcome," said Chief Executive Bogdan Badea. The stock will start trading on July 12 on the Bucharest bourse.

According to Reuters, the sale included existing shares held by Fondul Proprietatea (FP.BX), a fund managed by U.S. asset manager Franklin Templeton (BEN.N). Including an over-allotment option, it amounts to Fondul's entire 19.94% stake.

The government will retain its 80% holding in the country's largest energy producer, which has power capacity of 6.3 gigawatts from 182 hydroelectric plants.

While plans to list the company have been discussed for over a decade, an IPO was ultimately required by the EU as part of a deal to unlock post-pandemic recovery funds.

"We are talking about an event awaited for more than 10 years, as well as the biggest listing in the history of the Bucharest Stock Exchange," Romanian Energy Minister Sebastian Burduja said in a statement. "This historic success of listing Hidroelectrica shows that it was the right choice," he said.

The B&C team worked with the company and STJ Advisors (advising the company) and Rothschild & Co (advising the seller), alongside law firm Dentons who acted as Romanian, U.S. securities and English counsel to the issuer.

Citigroup Global Markets AG, Erste Group Bank AG, Jefferies International Limited and Morgan Stanley International SE were joint global coordinators for the transaction; Banca Comerciala Romana S.A., Barclays Bank Ireland PLC, BofA Securities Europe SA, UBS Europe SE, UniCredit Bank AG and Wood & Company Financial Services, a.s. acted as joint bookrunners; and Auerbach Grayson, BRD - Groupe Société Générale, S.S.I.F. BT Capital Partners S.A. and S.S.I.F. Swiss Capital S.A. acted as co-lead managers.