03/07/2025

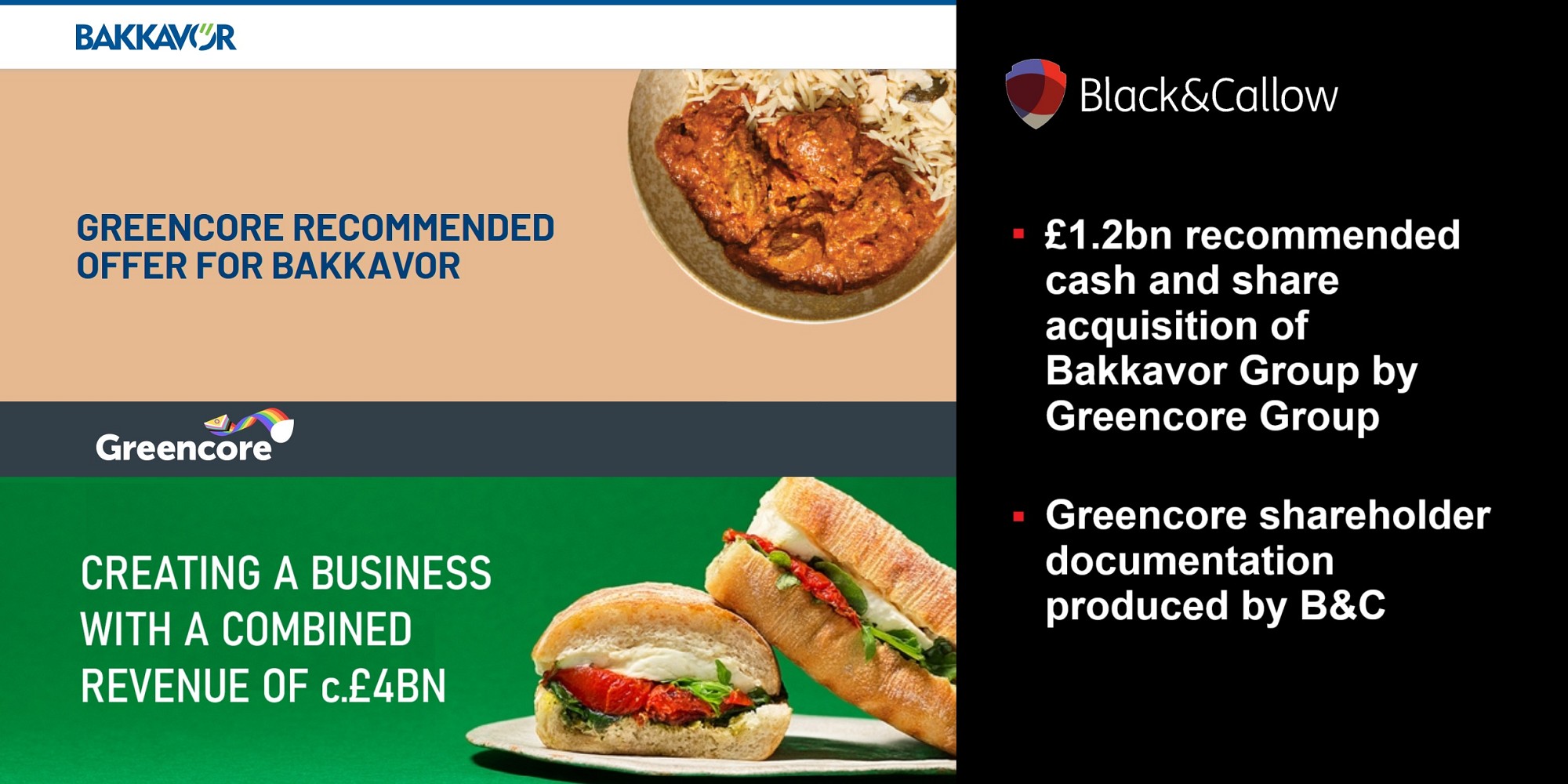

We’re delighted to have helped Greencore Group plc with its £1.2bn recommended cash and share offer for Bakkavor Group plc, to be effected by means of a court-sanctioned Scheme of Arrangement, which is expected to create a business with a combined revenue of c.£4 billion and over 30,000 employees.

Bakkavor is a leading provider of fresh prepared food in the UK, while Greencore is a leading manufacturer of convenience foods in the UK. The transaction is expected to bring together Greencore’s “food for now” expertise with Bakkavor’s “food for later” portfolios, which are highly complementary.

Commenting on the announcement, Greencore’s Chair Leslie Van de Walle said: “Greencore is a great business that continues to deliver for customers, consumers and shareholders. The strength of our performance has provided the platform to pursue a transformative growth opportunity in the proposed acquisition of Bakkavor… We have long admired Bakkavor and we are pleased to announce a transaction that will create a true UK leader in convenience food.”

Also commenting on the announcement, Simon Burke, the Chair of Bakkavor, said: “We are very happy with the progress made by Bakkavor delivering its strategy and significantly improved returns, both in the UK and abroad… The Transaction offers shareholders a significant premium, with an attractive combination of cash on completion and the ability to participate in the future value creation anticipated from bringing the two businesses together. For this reason our board is unanimously recommending it to shareholders.”

Our thanks to our wonderful clients at Slaughter & May and the company.

If you'd like to find out how we can help ensure the success of your tender offers, chat with us today: hello@blackandcallow.com