22/09/2025

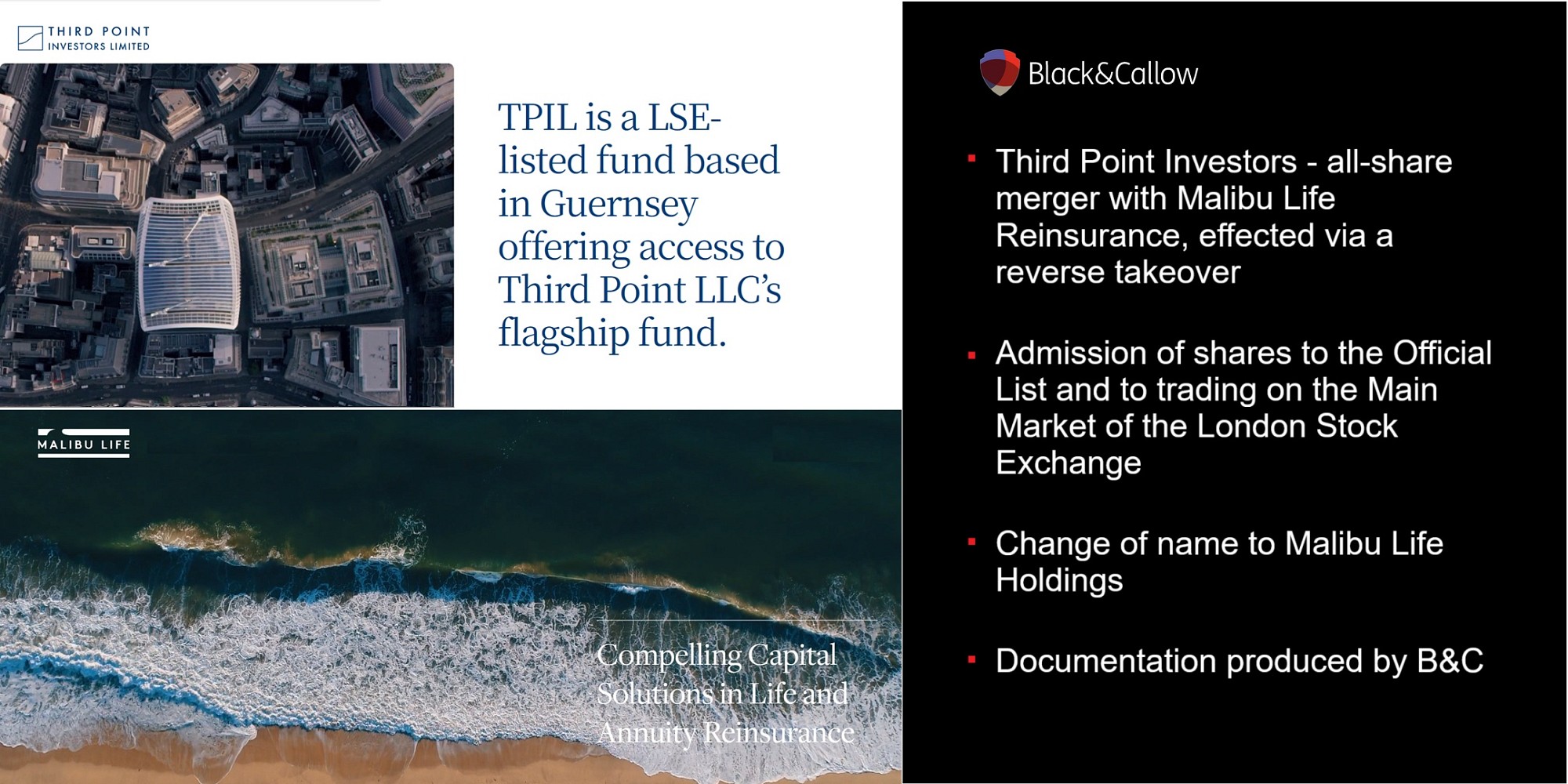

We’re delighted to have helped Third Point Investors with its all-share merger with Malibu Life Reinsurance, effected via a reverse takeover, with admission of its shares to the Official List and to trading on the Main Market of the London Stock Exchange. Following Admission, the company will be renamed Malibu Life Holdings Limited.

Third Point Investors Ltd (TPIL) is a London-listed feeder fund which invests in the flagship Third Point Offshore Fund managed by New-York-based private equity firm Third Point LLC.

In May this year, TPIL entered a sale and purchase agreement with the Cayman Islands-based annuity reinsurer Malibu Life Re in a move to address ‘structural headwinds’ facing the investment trust sector.

The RTO see TPIL acquire Malibu Life Re from Malibu Life Holdings LLC, which is owned by Third Point Opportunities Master Fund LP. As part of the deal, TPIL has moved its domicile to the Cayman Islands from Guernsey.

Dimitri Goulandris, TPIL’s Chair, noted: "Today is an important and exciting milestone as TPIL completes the acquisition of Malibu Life, to create a fully capitalised, reinsurance operating company. The Board is delighted to bring the company to the London market, where Malibu offers investors a unique and attractive opportunity to access the $1 trillion and growing fixed annuity market in the United States, through an established reinsurance platform with an experienced and capable management team.”

Our thanks to our wonderful clients at the company and advisors HSF Kramer and Jefferies.

If you'd like to find out how we can help ensure the success of your most critical M&A transactions, chat with us today: hello@blackandcallow.com