13/05/2024

Planning an IPO and how best to present your company to investors are significant endeavors which require careful strategizing and execution. Here's a ten-step structured approach to help you navigate this process:

1. Understand Regulatory Requirements: Ensure you understand the legal and regulatory requirements for an IPO in your jurisdiction. This includes compliance with securities laws, financial reporting standards, and governance regulations.

2. Assemble a Team: Form a dedicated team comprising professionals from finance, legal, accounting, and investor communications fields. Each member should bring expertise relevant to different aspects of the IPO process.

3. Financial Preparation: Work with your financial team to prepare audited financial statements, the Prospectus, and other required financial disclosures. Ensure that your financials are accurate, transparent, and comply with regulatory standards.

4. Select Underwriters: Choose reputable investment banks or underwriters to manage the IPO process. These firms will help with pricing the offering, underwriting shares, and coordinating with regulatory authorities.

5. Develop a Communications Strategy: Craft a comprehensive communications strategy that outlines how you will communicate with investors, regulators, employees, and other stakeholders throughout the IPO process and beyond. This strategy should include key messaging - your 'equity story' is critical - as well as media relations, social media engagement, and crisis communication plans.

6. Prepare Investor Materials: Develop investor presentations, roadshow materials, and other collateral to showcase your company's value proposition, growth potential, and financial performance to potential investors.

7. Roadshow & IPO Research: Conduct a roadshow to pitch your company to institutional investors, analysts, and potential shareholders. Use this opportunity to present your investment thesis, address investor concerns, and build relationships with key stakeholders. Your underwriters may also provide IPO Research material to analysts at the time of listing.

8. Engage with Regulators: Work closely with regulatory authorities, such as the US Securities and Exchange Commission (SEC) or the UK FCA, to ensure compliance with all disclosure requirements and resolve any regulatory issues that may arise.

9. Post-IPO Investor Relations: Establish robust investor relations practices post-IPO to maintain open and transparent communication with shareholders. This includes quarterly earnings calls, investor presentations, and responding promptly to investor inquiries.

10. Corporate Reporting: Post-listing, ensure Best Practice, engaging Reporting to investors. Be transparent with them about the risks and challenges facing your business, as well as the opportunities for growth. Managing expectations upfront can help build trust and credibility with investors over the long term. Ensure that your Reporting remains compliant with ESEF or xBRL requirements. Continuously evaluate the performance of your investor communications efforts and adjust your strategy as needed to optimize shareholder value and maintain investor confidence.

By following these steps and prioritizing effective communication and transparency, you can navigate the IPO process successfully and build strong relationships with investors for the future.

* * * * *

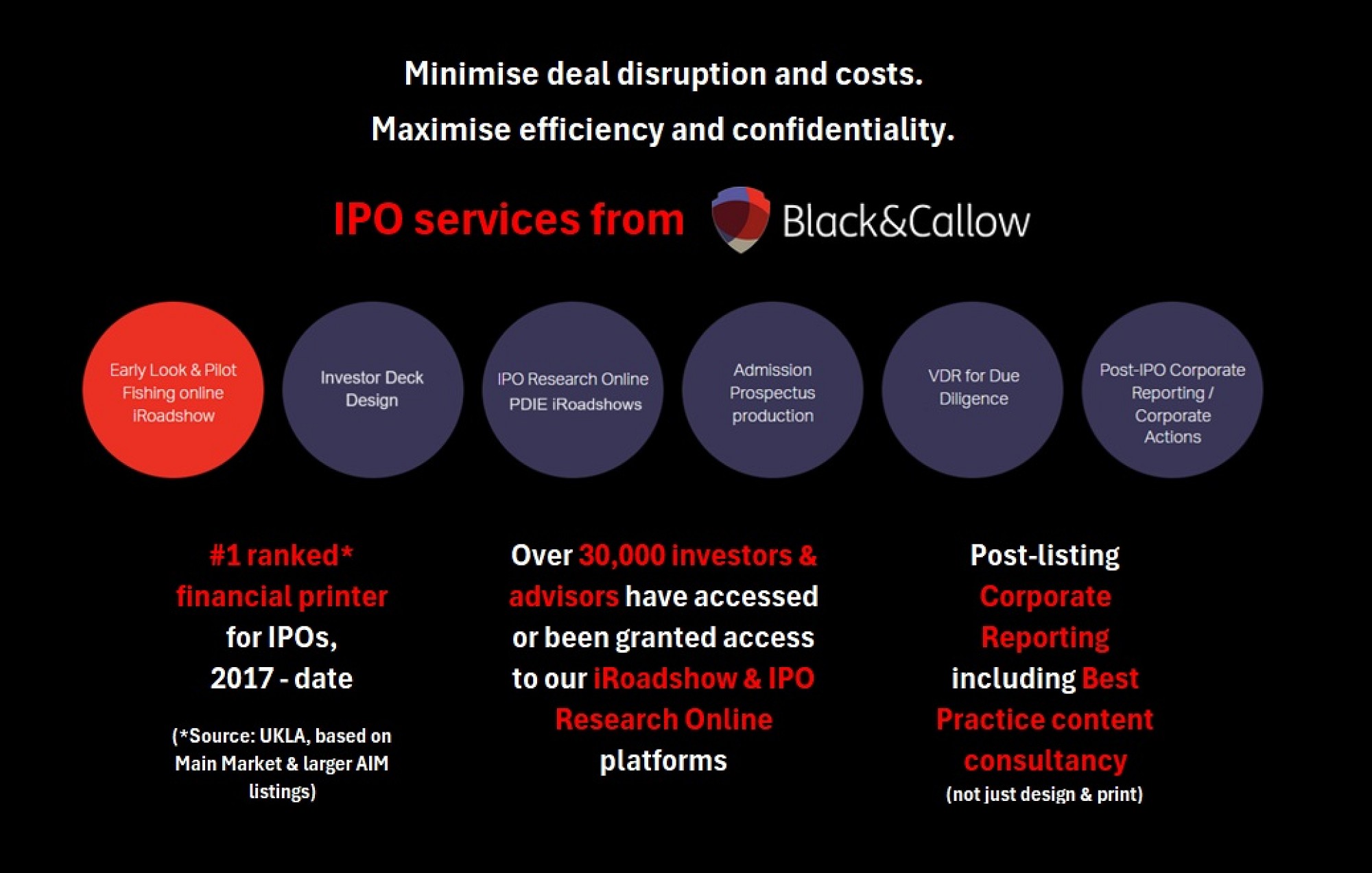

Of course, there are many parties involved in an IPO, and it can become overwhelming at times. One way to minimise deal disruption and to maximise efficiency and confidentiality is to appoint Black&Callow. From pre-IPO iRoadshow to post-listing Corporate Reporting, we can help you reduce the stresses of the process and become guardians of your 'brand' - a vital part of how you present your company to investors with authenticity and consistency.

We're the #1 ranked financial printer for Main Market and larger AIM Listings according to the UKLA, and over 30,000 of the leading global investors and advisors have accessed or been granted access to our iRoadshow and IPO Research Online platforms. With the largest financial typesetting team in Europe working around the clock on your confidential Prospectus production, dynamic investor deck design and post-Listing Corporate Reporting with Best Practice content consultancy too, you can ensure your investor communications are in safe hands.

To find out more, chat with us today: hello@blackandcallow.com